Looking at the headlines this morning we have the teaser that the Lib Dem’s will “demand” an increase to the income tax personal allowance in any coalition talks after the 2015 election.

Great headline – when will we start saving tax?

Before we all get carried away, have we not heard this before?

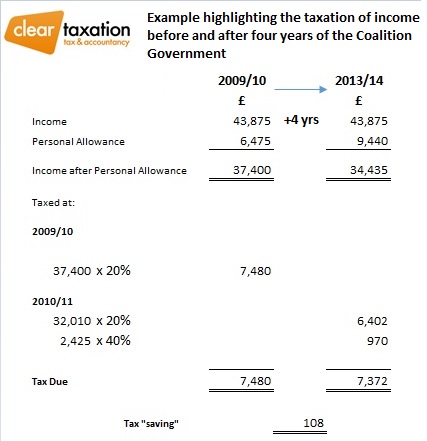

Did you know that when the coalition government was formed in May 2010 the personal allowance stood at £6,475 and in the current tax year has risen to £9,440. That is a big increase and has provided a real benefit for the lower paid, but it hasn’t helped everyone.

The part that doesn’t often get mentioned is that the higher rate band started at £37,400 in 2010. Fast forward to the current tax year and any income above £32,010 is taxed at 40%.

What does that actually mean?

Let us take a simple example.

If you were paid £43,875 in 2010, you would be a basic rate taxpayer and all your income would be taxed at 20%. If you are paid the same amount today you are now a higher rate tax payer.

I will not bore you with the maths, but you will be pleased to know that it is not all bad news. Looking only at income tax, even though you are a higher rate taxpayer, you are actually £108 a year better off today than you would have been in 2010.

Good news then, we are all better off?

Well, sadly not. The problem is that we should not stop the maths there. We also need to consider the increases in National Insurance, VAT, the freezing of the inheritance tax nil rate band and I haven’t even mentioned the general increase in the costs of living.

Still sounding good?

Dont get me wrong, the “demands” do make a good headline, but the whole picture should never be overlooked.

Press enquiries

cleartaxation are a leading team of tax experts based in the Central Belt of Scotland, but servicing clients all over the UK.

For journalists enquiries, we always have an opinion and are happy to help – please call Arlene direct on 07595 915 164